Should You Offer a Roth 401(k) Option?

August 25, 2022|Stephanie Irvin

Bottom Line Up Front

- Offering a 401(k) plan can help small businesses recruit and retain top talent and provide significant tax breaks and deductions.

- Finding the best retirement plan for your business requires an in-depth look at what your goals are, where your business is at, understanding what each plan has to offer, and more.

- This article is for businesses who want to know if they should also offer a Roth 401(k).

Congrats! You’ve reached the stage in your business where it’s time to set up a 401(k) plan. The availability of a 401(k) raises the status of your company and demonstrates your commitment to your employees’ future. Aside from the tax savings (which are pretty great when it comes to that increasingly stressful bottom line), offering good benefits leads to better morale, having employees stay with you longer, and attracting the right employees.

If you landed on this article, you’re probably debating on whether to add a Roth option along with the traditional 401(k). If so, sit back, relax, and grab a beverage of your choosing because I’ll show you why a Roth 401(k) is a good ace to have up your sleeve.

Finding the best retirement plan for your business

First, you want to look at a few factors that will help aid your decision. What does the structure of your business look like (are you set up as an S corp, an LLC, etc.)? What are you looking to get out of the plan?

Each company is unique. There’s not a one-size-fits-all, not even a one-size-fits-most plan. You’ll want to look at the tax advantages, understand what your long-term goals are (succession planning, how long you plan on owning the business, etc.), and where you’re at in your business.

For example, a business owner that has 10 employees, may still be dedicating most of their time to the business. They’ve got enough on their plate so the conversation might be focusing on how they can have a retirement plan that will attract employees and retain their current ones, while not having to spend a lot of time focusing on the administration of the plan.

But it’s important to note, that while a 401(k) is usually targeted toward businesses with hundreds of employees, that’s not to say that a small business shouldn’t open one. These plans have a lot of advantages that you can’t get with another plan so it may still be a good idea to explore even if you have one employee.

Can an LLC member contribute to a 401(k)?

But if you’re reading this you’ve probably already done a fair amount of research. So let’s look at how a Roth 401(k) option can enhance your current or future traditional 401(k).

How a Roth 401(k) compares to a Traditional 401(k)

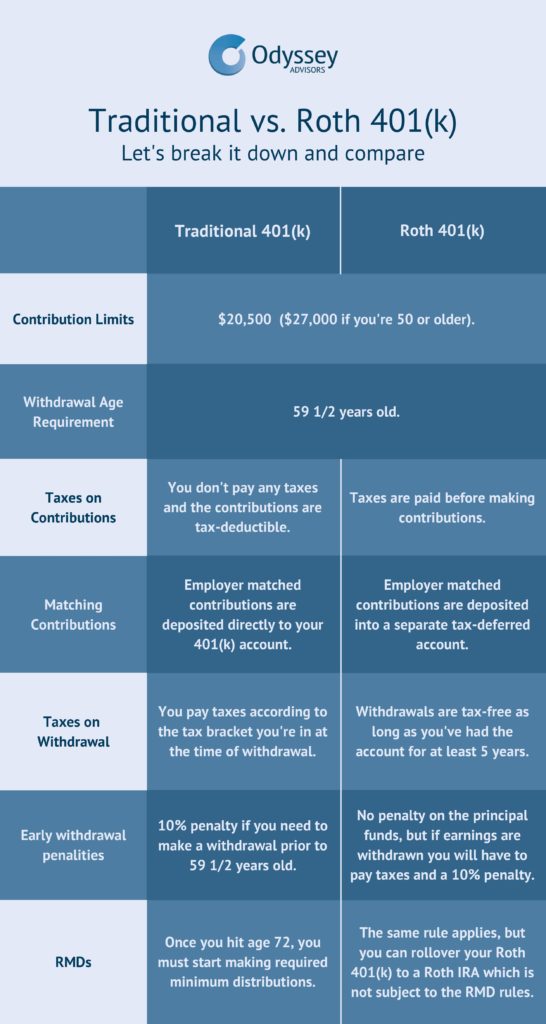

Both the Roth and pre-tax (traditional) 401(k) options are tools for you and your employees to save toward retirement. The biggest difference between a Roth 401(k) and its traditional counterpart are the taxes. With a Roth 401(k), you pay taxes now and with a traditional 401(k), you pay taxes later.

Here’s a quick side-by-side rundown of how these two plans compare:

Top 5 benefits of a Roth 401(k)

- Earnings grow tax-free

Because contributions are made after taxes have already been taken out, that means any earnings accumulated grow tax-free. - Ability to rollover to a Roth IRA

Like a traditional 401(k), a Roth 401(k) is subject to required minimum distributions (RMDs) at age 72. A Roth IRA, however, is not. One benefit of choosing the Roth option is that you can roll over your 401(k) into an IRA and avoid having to make RMDs. - Higher contribution limits than an IRA

The annual contribution limit for a traditional and Roth 401(k) for 2022 is $20,500 (or $27,000 if you’re age 50 or older). This is much higher than the IRA contribution limit which is $6,000 ($7,000 if you’re age 50 or older).

401(k) and Retirement Plan Limits for 2022 - Tax-free distributions during retirement

Contributions are made after-tax which means that qualified withdrawals in retirement are tax-free as long as you have met the 5-year rule. You must have your Roth 401(k) account for a minimum of 5 years in order to make a tax-free distribution. - Advantageous for those who believe their tax rate will be higher in the future

Let’s say you’re paying 12% in federal taxes and you plan to make more money in the future. This means the rate at which you’re currently taxed will most likely be higher in the future. This is often the case for younger employees and those near the beginning of their careers.

A great way to think about it – you’ll get your taxes out of the way early on at a lower rate and then you get to enjoy the earnings later on in life without the headache of taxes.

For example:

Assuming someone who is making $40k at the beginning of their career and paying very little in federal tax, plans to make more as they advance, a Roth 401(k) will only be marginally more expensive than a “regular” 401(k) at first. Down the line, when they’re ready to withdraw funds in retirement, it will be much cheaper.

The Bottom Line

Whether you’re already sponsoring a 401(k) plan or are looking into opening a traditional 401(k), adding a Roth option gives your employees the choice to choose how they’d like to save for their retirement. If you want to learn more about these two plans and other investment options, it’s always a good idea to reach out to an investment professional, a financial advisor, and/or a retirement consultant.

Whenever you’re ready, here are three ways we can help:

About The Author Stephanie joined the Odyssey Advisor’s team all the way from the Lonestar state in November of 2020. She is versatile in her abilities and has experience in copywriting, photography, and analytics. She helps tell our brand story and convey...

More Insights From This author

November 29, 2023

Stephanie Irvin

November 15, 2023

Stephanie Irvin

December 27, 2022

Stephanie Irvin