Ways to Reduce Your Taxable Income & Save Money

January 26, 2021|Parker Elmore

Background

December 2017, the Tax Cuts and Job Act (“TJCA”) was signed into effect. If you’re the owner of a pass-through entity (S corporation, LLC, or partnership), are you aware of the tax deductions available under the TJCA and the Internal Revenue Service (“IRS”) section 199A? Basically, taxpayers with taxable income that is less than the threshold may deduct up to 20% of their qualified business income (“QBI”).

Threshold Amounts

For single and head of the household taxpayers, the threshold amount is $164,900 of taxable income. For those taxpayers married and filing jointly, the deduction threshold amount is $329,800 of taxable income.

Using Cash Balance & Profit Sharing Plans to Your Reduce Taxable Income

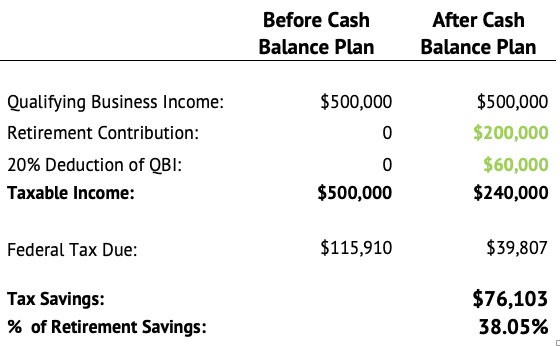

Business owners with substantial income and free cash can adopt a qualified retirement plan such as a Cash Balance Plan, a Profit Sharing Plan, or both. The qualified plan may allow for tax deferral of $200k or more per year depending on the age and income of the taxpayer. A qualified retirement plan, typically designed by an actuary, can help high-income taxpayers who are above the income threshold significantly reduce their income to meet the threshold for the 20% 199A QBI deduction.

Example Scenario

Background: Terry is 60 years old and married. He owns a successful accounting firm. His firm’s QBI is $500,000 and after discussing his options with his financial advisor and an actuary consultant, he realizes he could retain more of his earnings by adopting a Cash Balance Plan (“CBP”). The example shows Terry’s taxable income before the CBP and after.

*The above example is based on specific assumptions and should only be used for illustrative purposes.

The tax savings shown are only Federal Income Tax. There may also be additional state & local tax savings available to you depending on your state of residence.

Those retirement savings are included in an IRS qualified retirement plan and may be managed by you and/or your financial advisor.

If you’d like to learn more, reach out to an Odyssey consultant and we can provide an evaluation to determine if this will work for you.

Categories: Retirement, Taxes

About The Author As President and CEO of Odyssey Advisors, Parker Elmore is dedicated to quality service, expertise, and efficiency. With over 35 years of industry experience, Parker and the Odyssey team develop and implement solutions to the complex financial issues faced by...

More Insights From This author

October 2, 2024

Parker Elmore

August 28, 2023

Parker Elmore