The Perfect Time to Start a 401(k) Plan

January 27, 2020|Parker Elmore

“The best time to plant a tree is 20 years ago. the second-best time is right now.”

Chinese Proverb

If you’ve been thinking about starting a 401(k) plan, now is a perfect time! New changes through the SECURE Act are giving small businesses even more incentive to start. Employers with fewer than 100 employees who start a new 401(k) plan will now receive a tax credit to offset plan expenses for the first three years of the plan.

Download our 401(k) and 403(b) comparison guide for more information on key features.

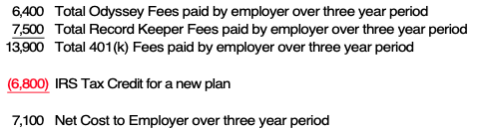

For a plan with ten Non-Highly Compensated Employees (NHCE) and two Highly Compensated Employees (HCE) here’s an example what that could look like:

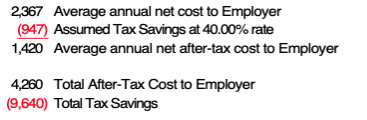

Right now, the IRS is willing to pay half of your plan fees for three years! Even better – the costs you’ll still pay are written off as an expense, so the net Employer cost is actually even lower:

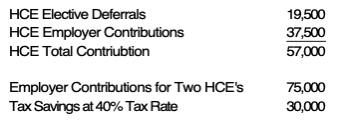

Start a 401k plan now and let the IRS pay almost 70% of your fees for three years. Add in the tax deductions you get just for making contributions to the plan, and it comes out to some serious savings. In 2020, $57,000 can be contributed to a 401(k) plan between Employer and Employee Contributions:

The IRS is offering you nearly $100,000 in tax savings over the next three years. Today is the perfect time for your business to start a 401(k) plan, save on taxes, and ramp up your retirement savings.

To learn how you can start, contact any Odyssey representative to lower your tax burden while increasing your retirement security.

Categories: 401(k), Retirement

About The Author As President and CEO of Odyssey Advisors, Parker Elmore is dedicated to quality service, expertise, and efficiency. With over 35 years of industry experience, Parker and the Odyssey team develop and implement solutions to the complex financial issues faced by...

More Insights From This author

October 2, 2024

Parker Elmore

August 28, 2023

Parker Elmore