How to Identify a Highly Compensated Employee

November 15, 2022|Andrew Taggart, ASA, EA, ACA, MAAA

Bottom Line Up Front

- The IRS requires that most plans perform an annual nondiscrimination testing to determine whether or not all employees are treated equally as far as tax advantages and contributions go.

- The nondiscrimination testing separates employees into two groups: non-highly compensated employees (NHCEs) and highly compensated employees (HCEs).

- To find out which employees are considered highly compensated employees, the IRS has two tests: an ownership test and a compensation test.

What is a Highly Compensated Employee?

Internal Revenue Service (IRS) Section 414(q) sets forth two tests to determine whether an employee is an HCE: an ownership test and a compensation test. If you meet the standards of either of these tests, then you are deemed to be an HCE.

- Ownership test: Have you owned at least 5% of the sponsoring company at any point during the current or prior plan year?

- Compensation test: Did you receive compensation of at least a certain amount determined by the IRS ($135,000 for 2022 and $150,000 for 2023) in the prior plan year? This amount increases with inflation at $5,000 intervals.

If one is classified as a highly compensated employee then their plan contributions are limited because the IRS wants to ensure that contributions aren’t disproportionately benefitting HCEs over NHCEs.

How to Identify if Someone is a Key Employee?

The IRS has three set tests to determine whether an employee is a Key Employee: a 5% ownership test, a 1% ownership test, and an officer test. If you meet the standards of any of these tests, then you are deemed to be a Key Employee.

- 5% Owner test: Have you owned at least 5% of the sponsoring company at any point during the current or prior plan year?

- 1% Owner test: Have you owned at least 1% of the sponsoring company and did you receive compensation in excess of $150,000 for the current plan year? This dollar amount is set and does not increase with inflation.

- Officer test: Are you an officer of the sponsoring company and did you receive compensation in excess of an amount determined by the IRS ($200,000 for 2022 and 2023) in the current plan year? This dollar amount increases with inflation at $5,000 intervals.

How to Identify if Someone is an Owner?

Someone is deemed to be an owner if they have owned at least 5% of the sponsoring company at any point during the current or prior plan year. This can mean different things under different company entity types.

- Corporation: The greater of the value of all classes of stock held by the individual as a total percentage of the value of the company, or the voting power of all classes of stock held by the individual as a percentage of all stock with voting rights.

- Partnership: The greater the percentage of the capital interest or profit interest.

- LLC or LLP: The percentage of membership interest out of the total membership interest.

Additionally, if you have the option to acquire stock, even if you have not exercised those options yet, they are also used to determine whether you are an owner or not.

What is Ownership Attribution and How Does It Work?

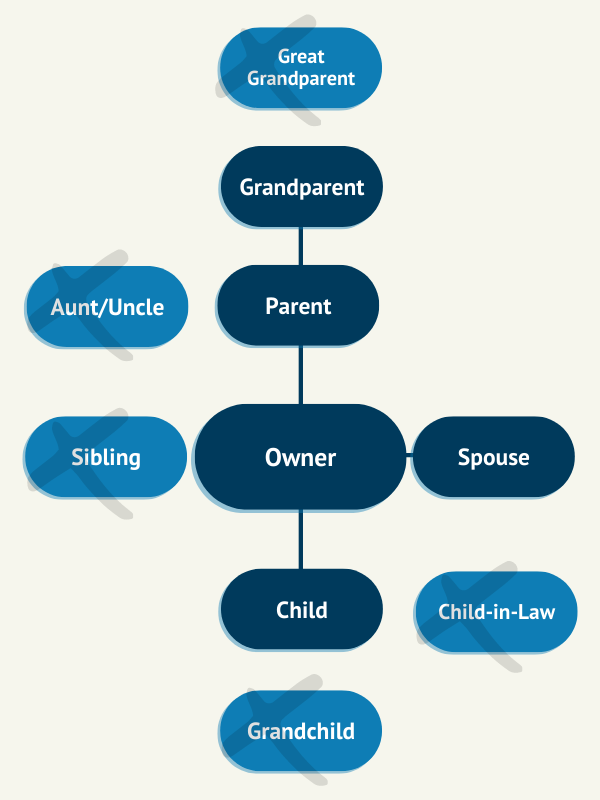

In short, if you are deemed to be an owner of the sponsoring company then your family members may be deemed to be owners of the sponsoring company as well. Below is a chart to describe which family members have attributed ownership and which are not:

What Do These Different Designations Mean and Why Do They Matter to Me?

The name of the game is non-discrimination testing. The IRS requires that most retirement plans perform a non-discrimination test every year. These tests are used to determine if the plan is disproportionately benefiting highly compensated employees over non-highly compensated employees (NHCEs). If the plan fails these tests it can lose the tax deductions that it receives for the contributions made to the plan.

The Key Employees designation is used in determining if the plan is considered “top-heavy”. A plan is considered top-heavy if the total account balances or total present value of accrued benefits is disproportionately attributed to Key Employees. If a plan is deemed to be top-heavy it may be required to make minimum contributions to the plan for non-key employees.

The owner designation is important to keep in mind because of the attribution rules listed above. When you are deemed to be an owner you are then deemed to also be a Key Employee and a highly compensated employee. This can have a large effect on your non-discrimination testing. The most common issue we see is that an owner will hire their child – if the plan design doesn’t explicitly address benefits paid to key employees, this may result in them receiving employer contributions or benefit allocations. Often, the owner’s child is one of the youngest employees at the company – so even if they are paid a very small amount they are still considered a highly compensated employee and can cause your non-discrimination tests to fail.

Whenever you’re ready, here are three ways we can help:

About The Author Andrew joined the Odyssey Advisors team in September of 2018. He works with clients to create and administer retirement benefit plans. He has been involved in helping municipalities create solutions for their plans under the changes of GASB 74 and...

More Insights From This author

June 24, 2021

Andrew Taggart, ASA, EA, ACA, MAAA