How Do Social Security Benefits Work?

April 25, 2022|Francis Fraine

Bottom Line Up Front

- Throughout your entire working life, you will pay a percentage of your gross wage income to the Social Security tax, also known as the Old-Age, Survivors, and Disability Insurance (OASDI) tax.

- As you work and pay into Social Security, you will accumulate an earnings record which will help determine your Social Security benefit when you retire or become unable to work.

- The benefit amount you receive is based on your 35 highest-earning years (these need not be consecutive) and your average indexed monthly earnings (AIME).

Social Security provides benefits to retirees and those unable to work due to disability or disease. This program, which serves as a financial safety net for many people, is funded with gross wage income withheld from each eligible person’s paycheck.

Essentially while you’re employed, you’ll pay into Social Security and when you retire or become unable to work, that’s when you’ll receive the benefits.

How Does Social Security Work?

Throughout your working life, you’ll pay 6.2% of your gross wage income from each paycheck and so will your employer(s). That’s a total of 12.4% towards your social security. If you’re self-employed, you must pay the full 12.4% yourself.

So 12.4% of My Life’s Pay Goes Towards Social Security?

Not entirely because it depends on your income. Any wage income below the Social Security Wage Base* after qualified insurance and reimbursement account is subject to the 12.4% tax. Any income you earn beyond the Social Security wage base cap amount is not subject to the tax.

*This figure is subject to inflation-based increases on an annual basis. For FY 2021, it was $142,800 and $147,000 for FY 2022.

How are Social Security Benefits Calculated?

As you work, you accumulate what’s known as an earnings record (sometimes referred to as a work record). The Social Security Administration (SSA) will use your earnings record to calculate your monthly benefit when you reach what’s called the “Normal Retirement Age” (NRA).

The first step when calculating your benefit is to “index” each earnings year and then take your highest 35 years (these need not be consecutive) of working and produce what’s called your “Average Indexed Monthly Earnings” (AIME). To do this, add together all of your 35 highest-paid years and then divide that number by 420 (35 years x 12 months).

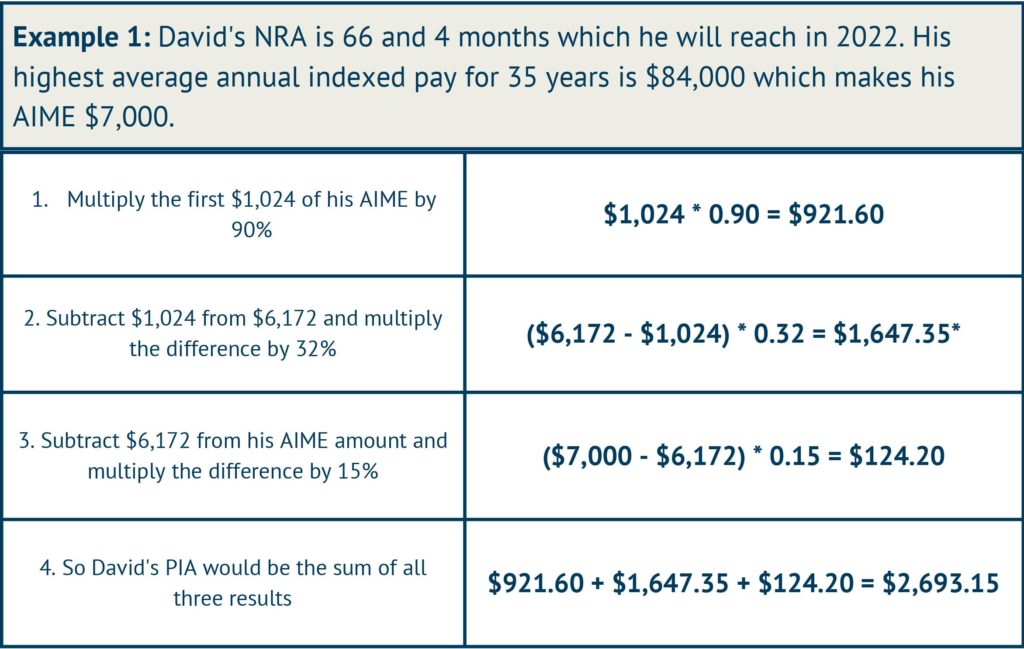

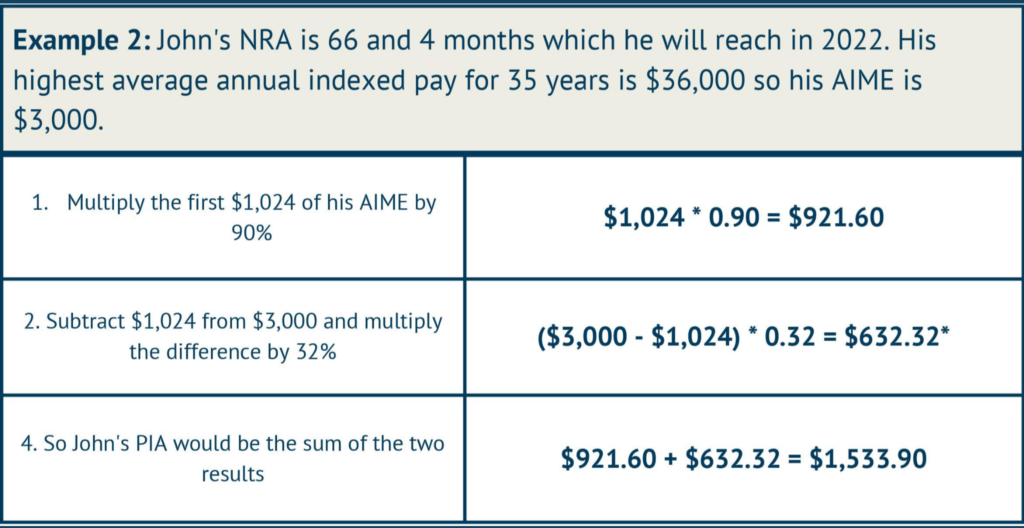

The second step is to determine your Primary Insurance Amount (PIA). PIA is the monthly benefit that you’ll receive from Social Security if you claim your benefits at your Normal Retirement Age. That age is 66 years old for anyone born in 1943-1954 and gradually increases to 67 years old for people born in 1960 or later.

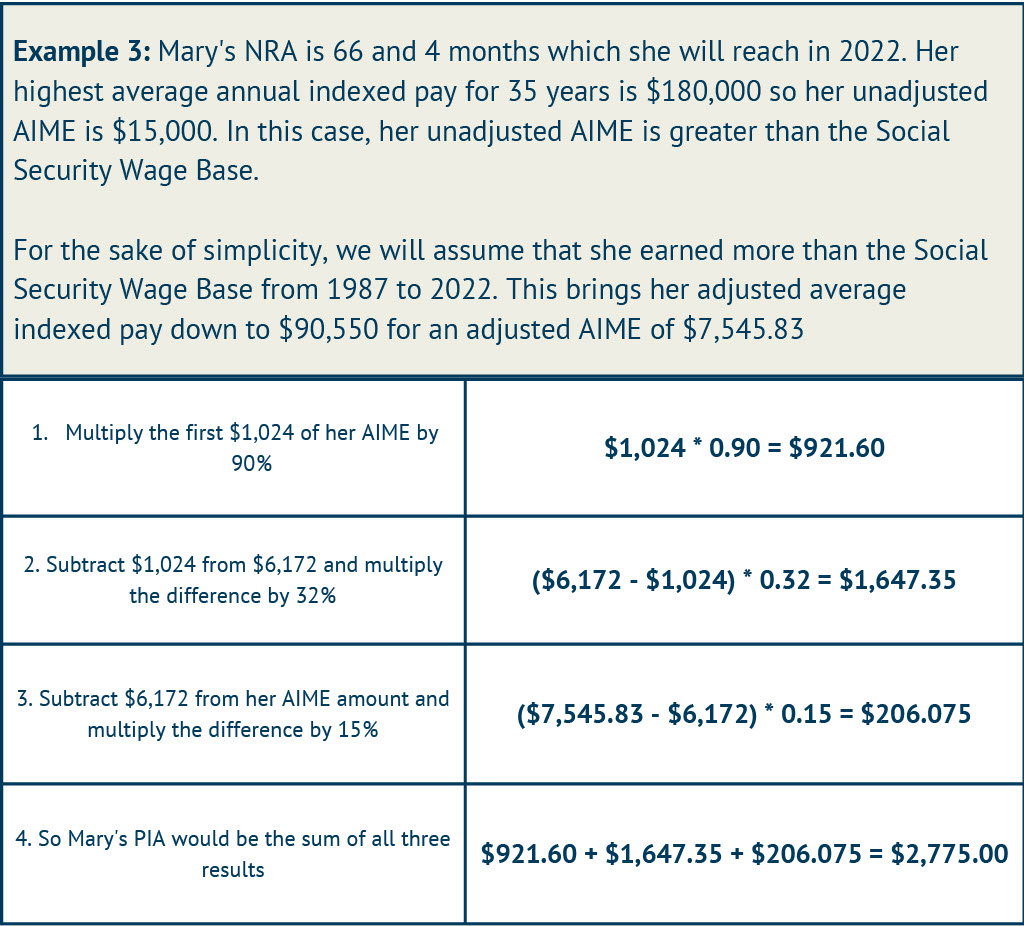

Here’s how your PIA is determined with figures for 2022:

- 90 cents of every dollar for the first $1,024 of your AIME

- 32 cents of every dollar of your AIME between $1,024 and $6,172

- 15 cents of every dollar of your AIME over $6,172 and less than the Social Security Wage Base for the given year*

*Please note, there are no benefits if your AIME exceeds the Social Security Wage Base in the given year

Now let’s look at some examples

When Does Social Security Start?

The earliest you can start collecting Social Security benefits is age 62 and the latest is age 70. In the examples above, you’ll notice that we used a Normal Retirement Age (NRA) of 66 years and 4 months. The reason for that is that your monthly benefit is calculated to be received on your “Normal Retirement Date” (NRD), which is based on your year of birth.

But, if you decide to claim your benefits before your NRD, you won’t receive the full benefit based on the calculation above. Another caveat, if you decide to delay claiming your benefit between your full retirement age and 70, you will receive an increased benefit.

These reductions and increases can be seen here. Additionally, there is a calculator where you can input your date of birth and desired retirement age to see the effect of early or delayed commencement of benefits.

Can I Claim Benefits Before My Normal Retirement Age?

Yes, you can claim benefits as early as age 62. Your monthly benefit will be reduced for early commencement – here’s a link to the Social Security Administration that breaks down the effects of early retirement on your benefit.

As an example – if your Normal Retirement Age is 67 and you decide to begin benefits at age 62, you will receive 70% of your monthly PIA benefit. Also, you will potentially lose out on higher years of earnings that would increase your monthly PIA benefit. Please note that this reduction remains for your entire life so please consult with your financial advisor prior to making that decision.

Can I Delay Taking My Benefits Beyond My Normal Retirement Age?

Of course. You will receive a delayed retirement credit for each year that you defer your benefits beyond your Normal Retirement Age. However, no credit is given beyond age 69 so your benefit will reach its maximum with retirement at age 70. For those born in 1943 or later, the delayed retirement credit is 8.0% per year, and that higher benefit will apply for your entire life.

What if I Don’t Work for a Few Years?

Your monthly benefit is based on your 35 highest-earning years of work. If you don’t work for a few years or have fewer than 35 years of earnings, those years will be factored in as $0 for determining your highest 35 years of earnings. For example, if you worked a total of 30 years, those years will be used to determine your average in addition to five years of zero pay.

How do Spousal Benefits Work?

To be eligible to collect spousal benefits you need to be married for one continuous year. At your NRA, you can collect half your spouse’s monthly benefit. The same reductions and increases mentioned above will apply with one exception. If you were born before January 2, 1954, and your spouse is actively receiving their own benefit, you can collect spousal benefits and defer your own up to age 70 and receive the increase.

If you were born on or after January 2, 1954, there is no increase for delaying spouse benefits past age 67. If your spouse is already receiving their benefit when you file, you’ll get the higher of:

- Half your spouse’s benefit

- Your monthly benefit

If your spouse is not receiving their benefits and you file for yours before they do, you can later switch to receive spousal benefits based on their earnings record. However, you will receive a reduced amount under their benefits to reflect the fact that you were already receiving benefits from Social Security. Unfortunately, there aren’t as many “tricks” when it comes to starting and suspending benefits for those born on or after January 2, 1954.

Are There Any Disability or Death Benefits?

Should you become disabled prior to starting your retirement benefits, your spouse and eligible family members may be eligible to receive benefits early. Eligible family members include spouses, ex-spouses, and children. Details on specifics with regards to who qualifies, how much they will receive, and maximum family benefits can be found here.

Are Social Security Benefits Adjusted for Inflation?

Yes, those already receiving benefits typically see an increase each year as a result of inflation. As for the amount, that is based on the “Consumer Price Index for Urban Wage Earners and Clerical Workers” (CPI-W).

Please note if the CPI-W doesn’t increase, there is no increase in benefits. For 2022, the cost-of-living increase is 5.9%. While the 2023 cost-of-living increase is unknown, it is projected to be in the 7.6% to 8.9% range at the date this article was written. You can see the historical cost of living increases here.

Is It Better to Take Social Security at my Normal Retirement Age or to Delay It?

Unfortunately, there isn’t a “one size fits all” answer. Whether you wait to claim your benefit or start them at your NRA should be based on your individual financial needs, expected longevity, and ability to re-enter the workforce if needed. It’s best to seek out a financial advisor that specializes in maximizing Social Security benefits and work with them to develop a plan that best suits your circumstances.

The Bottom Line

Understanding your benefits in retirement will give you increased confidence, relieve some stress, and help you plan ahead for your future. This article is meant to provide a general understanding of how Social Security benefits work. If you are looking for a more in-depth analysis, please consult a financial advisor that specializes in Social Security. They can help verify your calculations and provide advice on when to claim your benefits based on your personal situation.

Categories: Retirement, Taxes

About The Author As Director of Operations at Odyssey Advisors Francis is excited to utilize a decade of industry experience to assist the Odyssey team in developing solutions to client problems in a complete and efficient manner. With a history of observing confusion...

More Insights From This author

May 18, 2022

Francis Fraine

April 30, 2021

Francis Fraine